Has Microsoft Teams Growth Reached Its Peak?

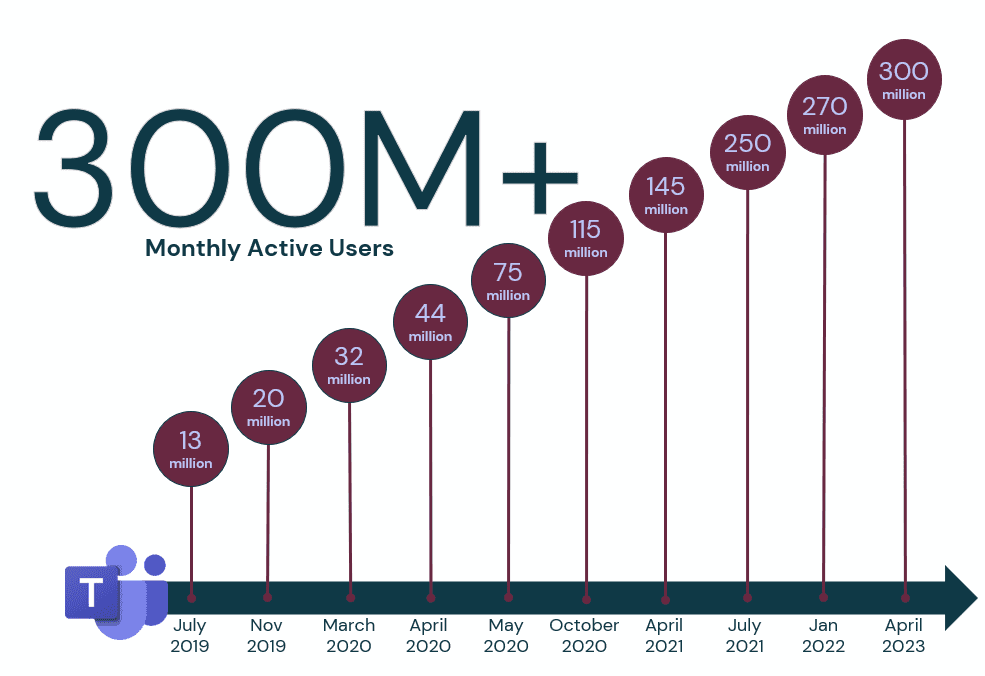

(Article updated Q3 2023) The growth of Microsoft Teams seems never-ending. At the end of April 2021, Microsoft Teams reached 145 million daily active users. Then in August 2021 Microsoft revealed the platform had more than 250 million monthly active users, after changing its counting metric. In one of its 2023 financial releases Microsoft announced that Teams now had more than 300 million monthly active users.

Due to rising digital transformation programs and remote work, Microsoft Teams growth records have been obliterated shortly after publishing.

In this post, we discuss how and when Microsoft Teams momentum kicked off and what their future growth looks like. And if it is likely to stop any time soon.

Table of Contents

Current Microsoft Teams growth

If you can remember back to November 2019, Microsoft proudly announced that Teams had 20 million daily active users (DAU).

That was a pretty big deal at the time. It dwarfed user numbers announced by collaborative competitors like Slack, which at the time had around 10 million.

“We define DAU as the maximum daily users performing an intentional action in the last 28-day period across the desktop client, mobile client and web client,” – Microsoft.

Not even Microsoft could have predicted the growth that was to follow.

In fairness, few were anticipating a global pandemic that would force millions out of the traditional office.

Enforced remote working drove a huge demand for technology solutions that could enable productivity in a dispersed team, and Microsoft Teams was there to answer the call.

Microsoft reported on March 11, 2020, that Teams had 32 million DAUs.

Then, a week later, they announced updated figures with 44 million DAUs.

12 million new users in just over a week isn’t bad going.

The next public figures were announced at the end of April. With the total DAU number at 75 million – that’s 31 million more users in under two months.

I must admit I hadn’t been expecting Microsoft to announce another milestone for a while.

I was surprised that we hadn’t witnessed a huge Microsoft fanfare when the platform reached three figures at 100 million users.

But now I know why.

Microsoft waited to hit that globally renown landmark of 115 million before going public in the later part of 2020. Subsequently, the Teams DAU number was then updated by Microsoft to 145 million.

After their Q4 2021 Earnings Release, revealing double digit growth across its business units, Microsoft changed how it counts and tracks its user base in Teams. Microsoft has now moved from reporting DAU to monthly active users (MAU).

In an updated release it revealed that Teams had more than 300 million MAU. When this is compared to the previous DAU number it implies that 58% of Teams overall users are using the application on a daily basis.

The reasons behind the shift away from reporting DAU to MAU are unknown. It may be easier for Microsoft to measure on a monthly basis, it does also bring user counts in line as MAU is more widely used in the industry and by Microsoft when reporting other user counts, such as Office 365.

On current online activity relating to Microsoft Teams growth, Dominic Kent, Director of Content Marketing at Mio, says:

“Our blog reached over 100,000 views per month with queries relating to Microsoft Teams. While it was a high-performing blog before the pandemic, we saw a huge spike of inbound enquiries due to the number of new users”.

Is Microsoft Teams profitable?

The short answer is that only Microsoft knows for sure.

Even with the huge growth in Teams users, we can’t be certain how much profit, or even revenue, the application itself generates for Microsoft.

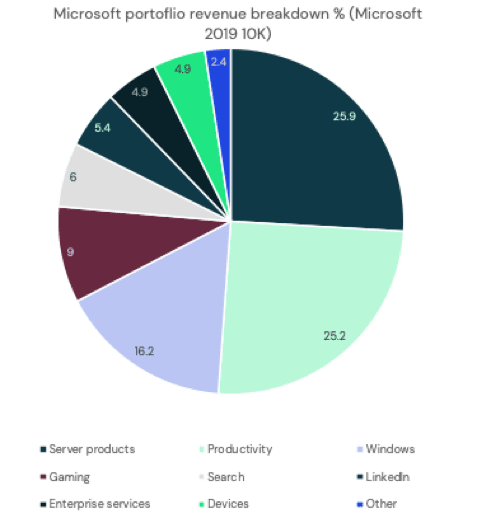

Microsoft doesn’t break down revenue in its Productivity and Business Processes division – the segment that Teams sits in – by individual application.

Microsoft 365, both consumer and commercial revenues, are included in this segment alongside Teams, Dynamics, and LinkedIn.

Productivity formulates more than a quarter of Microsoft’s annual revenue.

Revenue in the Productivity and Business Processes division has been rising steadily at around 14% since 2017. Microsoft’s 2020 annual report revealed this growth was bolstered by the rise in remote working.

Annual revenue for the segment now exceeds $46 billion.

Trying to gage what proportion of this revenue Teams is responsible for is difficult.

Around 50% of Microsoft 365’s 345 million+ commercial users now use Teams. So, you can estimate that Teams might generate revenue of between $4 and $8 billion.

This is a slightly moot extrapolation though as the strength of the Microsoft 365 suite is the combination of all the applications included.

Trying to separate the suite into its constituent parts to calculate value is a bit like trying to work out which part of your knee is most important.

You might be confident you’ve fixed the bone but having a whole working knee is where the real value is. Muscles, tendons, and all.

So, as we can’t be sure about Teams’ revenue, we can’t be sure about its profitability.

It was undoubtedly costly to develop. But, once it reached a certain point, those associated development costs will have fallen despite Microsoft’s continued focus on taking the application clear of competition.

Hosting the application will of course require considerable infrastructure. But, given Microsoft’s existing resources in Azure and huge monopolies of scale, you can assume this will be as efficient and as cost effective as possible.

Even with substantial infrastructure and development costs you can assume Teams isn’t a loss leader.

As well as attracting businesses to the Microsoft 365 suite overall, with its collaborative appeal, it must represent a significant margin opportunity for Microsoft.

How does Microsoft Teams make money?

Microsoft’s traditional model for revenue came from one off costs for licensing Original Equipment Manufacturer (OEM) products like Windows and Office software.

Now, in the age of consumption, this has shifted to recurring revenue subscriptions.

Teams is available as part of the Microsoft 365 suite of applications or as a freemium version.

On a subscription basis, Microsoft generates revenue and profit from organisations paying to utilise the Teams application.

Although, as mentioned above, the exact margin it will generate from Teams is unknown.

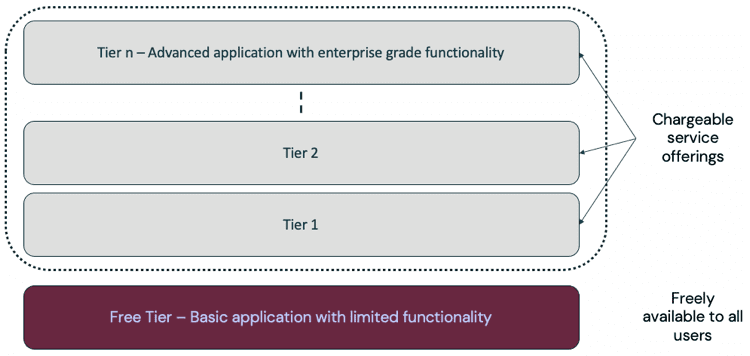

The freemium model is a bit more nuanced.

Microsoft are relying on users wanting to utilise the Teams application. And then on them purchasing other related products or services to co-exist alongside it. Possibly within the realms of Dynamics or Azure.

As I said above, Teams can’t be considered as a loss leader but Microsoft is using Teams to capitalise on the demand for collaboration services and attracting new customers into the overall Microsoft eco-system.

Microsoft Teams Free

The freemium version of Teams is limited in terms of features and functionality.

Microsoft hopes users fall in love with the free version and then look to upgrade to chargeable packages which include more advanced enterprise feature sets including enhanced security and analytics.

This freemium/upgrade model is one that is established and has been used successfully within the enterprise software sector.

You can see how this model works below.

Microsoft Teams add-ons

Overlay services is another area where Microsoft hopes Teams can drive further revenue.

Telephony, for example, is another area where Teams provides additional revenue streams.

Teams does not include telephony services as standard but organisations can apply additional overlay licences, generating supplementary revenue streams for Microsoft, that allow users to make phone calls natively within the Teams application.

Cavell’s latest research forecasts huge growth in this Teams telephony market and Microsoft might look to replicate this tactic in other supporting areas like Teams’ integration capabilities or maybe even contact centre.

Why Microsoft Teams is winning the collaboration popularity contest?

There are a few reasons behind Microsoft Teams extraordinary growth.

Firstly, you have to give credit to Microsoft for rapidly developing the application.

Although it wasn’t from a standing start, Microsoft leveraged some of the knowledge and technologies gleaned from Skype for Business, the creation and development of Teams has been impressive.

Pooling vast internal resource and knowledge, coupled with feedback from Microsoft’s huge user community, it has managed to take Teams from a basic starting point to a position as a class leading collaboration solution in a relatively short amount of time.

The pace of development and the addition of new features and functions is relentless and – to Microsoft’s credit – that is a big part of its success. During a 6-month period in 2019, more than 100 new features were added to the application.

Current global circumstances undoubtedly Microsoft Teams growth.

The demand for consolidated communication services, in the form of collaboration apps, boomed and Teams sat in a prime position to capture huge swathes of the market.

In early 2020, 62% of communication service providers reported more than a 50% increase in demand for team collaboration services.

Teams’ position with the Microsoft 365 suite makes it easy to rollout alongside other familiar applications that organisations are already using like Word, Excel, and PowerPoint.

The key to Microsoft Teams growth

It is this point that I believe is the crucial advantage: Teams’ position within the Microsoft 365 productivity suite.

Microsoft’s suite of productivity applications controls a huge section of the market with limited competition from companies like Google with its G Suite proposition.

Cavell’s Enterprise Insight Report for 2020 confirms that Microsoft is winning the battle in this area too.

Teams is included within the majority of Microsoft 365 bundles and therefore provides any easy route for many organisations to add a collaboration application for their users at no extra cost or inconvenience.

The Teams app also leverages the familiar look and feel of a Microsoft 365 application and that recognisable UI provides users with an intuitive experience that doesn’t necessarily require hours of training.

Microsoft’s FY22 Q3 results provided an update on he Office 365 paid user number as “nearly 345 million,” this correlates with the roughly 17% year-over-year increase in Office 365 commercial revenue.

With Teams achieving more than 80% penetration into 365’s numbers there is a still a lot of scope for further user growth – that might even be considered relatively low hanging fruit.

When will Microsoft Teams growth stop?

The growth isn’t going to stop for quite a while.

Tom Arbuthnot, Microsoft MVP and Principal Solutions Architect at Modality Systems, said that:

“Microsoft Teams growth has been staggering, not just the raw DAU numbers, but the speed with which individual large companies have rolled out and adopted, mainly due to the pressure of the pandemic and remote working. Yet, many organisations are just at the beginning of truly maximising their investment in Teams, moving beyond just meetings and chat to true collaborative working and telephony.” — More information on updates for Teams and the wider Microsoft 365 suite can be found on Arbuthnot’s blog, Tom Talks.

Growth isn’t then going to stop but you might expect the growth rate to slow from its accelerated 2020 rate. As demand for collaborative services reduces, the market reaches higher levels of saturation.

However, you can expect Teams to move closer and closer to 100% parity, and therefore penetration, within Microsoft 365’s user numbers.

We might not see the Teams growth rate slow significantly until we are much closer to 400 million Microsoft 365 and Teams users.

To try and see further into the future is more difficult but you can look to Microsoft 365’s commercial seat growth to provide an indication of what we might see.

The pandemic has made forecasting complex as the long-term impacts in terms of market saturation and dynamic transformation are not fully visible yet.

Prior to the pandemic, up until Q1 2020, Microsoft 365 seat growth has been declining quarter on quarter down to a growth rate of 21%.

So, once Teams reaches parity with 365 and the global market for consolidated communication services returns to whatever is left of ‘normality’ we should see the growth rate steadily decline from around 20-25%, to stabilise at an annual growth rate of around 4-6% – mirroring what we see in other fully mature software markets.

Even with uncertain forecasts, one thing is for sure.

Microsoft will make sure it does everything in its power to maximise the Teams gravy train during this boom period.

To learn more about the growth of the Microsoft Teams within the Unified Communication’s market, download Cavell’s latest Cloud Communications Market reports.

Share this post

Patrick Watson

Patrick Watson is Cavell’s Head of Research. His main area of expertise is the cloud communications industry, with a particular focus on the collaboration sector. For over ten years, Patrick has been a noteworthy member in the technology community, with a degree specialising in broadcast journalism and data analytics.