Have the Altnets dug their own graves?

With news of Altnet consolidation and job cuts from major providers becoming increasingly common in the UK, Cavell wanted to dig into the state of the Altnet market and weigh in on what might happen to these providers over the next few years, and what investors need to know to make smart decisions in this space.

As the forecasted Altnet land grab ramps up 2024, there are certain key indicators that may determine if a certain provider sinks or swims, along with which may be viable targets for a regional roll up.

What is an Altnet?

An Altnet is a company with its own independent telecommunications network. Altnets, as indicated by the name, began to form around 10 years ago in the UK as an alternative to OpenReach, the main telecommunications network provider in the country. Unlike OpenReach which initially built its network using copper cable, the vast majority of UK Altnets are pure fibre networks. With this promise of faster and more reliable speeds from these fibre networks, Altnet providers set out to build networks in hard to reach locations across the UK where OpenReach would not build.

The UK government supported this roll-out of superfast broadband through Project Gigabit, which provided investment to alternative networks with the target of providing broadband to 85% of the UK by 2025 and nationwide by 2030.

The necessity for broadband in hard to reach and rural communities provided a strong business case for Altnets, which led to a flurry of private investment and an explosion of building in all regions of the UK, from Scotland to Northern Ireland to Wales. Analysts estimate that there are around 100-130 Altnets in the UK, but an exact number is difficult to confirm.

Recently, however, many Altnets have faltered as overbuild and inability to attract customers has led analysts to predict that there is going to be a push for consolidation in the market. This year alone Fern Trading combined AllPoints Fibre, Giganet, Jurassic Fibre and Swish Fibre; Community Fibre acquired a majority stake in Box Broadband, and nexfibre acquiring Upp, a deal facilitated by Virgin Media 02.

Anatomy of an Altnet:

In order to make a prediction about what Altnets will be able to withstand the upcoming consolidation, or what key indicators might determine whether an Altnet makes a worthy investment, it is first important to give an overview about the services Altnets provide as well as their key differentiators (spoiler: there aren’t many.)

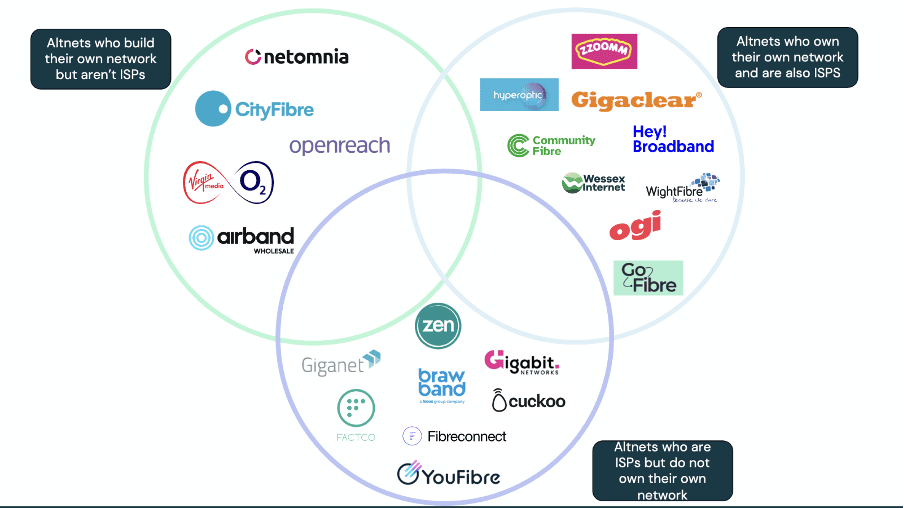

First, there are three different types of Altnets. Altnets who are ISPs (internet service providers) and also build their own network, Altnets who solely build their own network and wholesale it out to other ISPs, and Altnets who are ISPs but run their network on some other providers’ networks. As shown in the diagram below, altnets such as CityFibre and Netomnia wholesale their services to ISPs but aren’t ISPs themselves. For example, Giganet, Cuckoo and Brawband are all ISPs using City Fibre’s network. On the other hand, many altnets independently have built out and own their own network, Hyperoptic, Wessex Internet, Ogi being members of this category.

The vast majority of Altnets in the UK have very similar offerings and market their product in nearly identical fashion. After undertaking a survey of over 80 Altnets and their websites Cavell concluded there is very little that differentiates one Altnet from another. In terms of offering, the vast majority of Altnets offer both home and business broadband, with a handful providing a more advanced offering that includes telephony or security services. Certain providers, such as Hyperoptic and Ogi claim to offer more of a full range of MSP services, but this is the exception to the rule.

Anatomy of an altnet

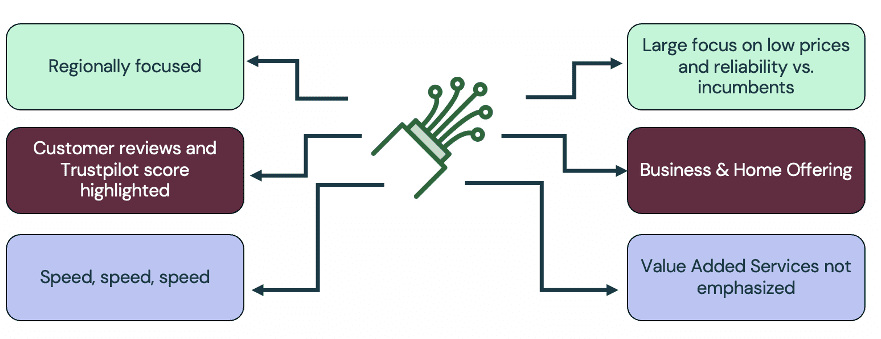

After scrutinising the websites of these 80 providers, Cavell has determined that nearly all Altnet webpages look virtually identical and seem to be touting similar differentiators. As the diagram above displays, UK Altnets, without exception, advertise their superiority to other providers based on four easily identifiable criteria. These are:

- The speed of network

- Low-cost relative to the incumbent providers

- Strength of customer reviews

- Regional focus

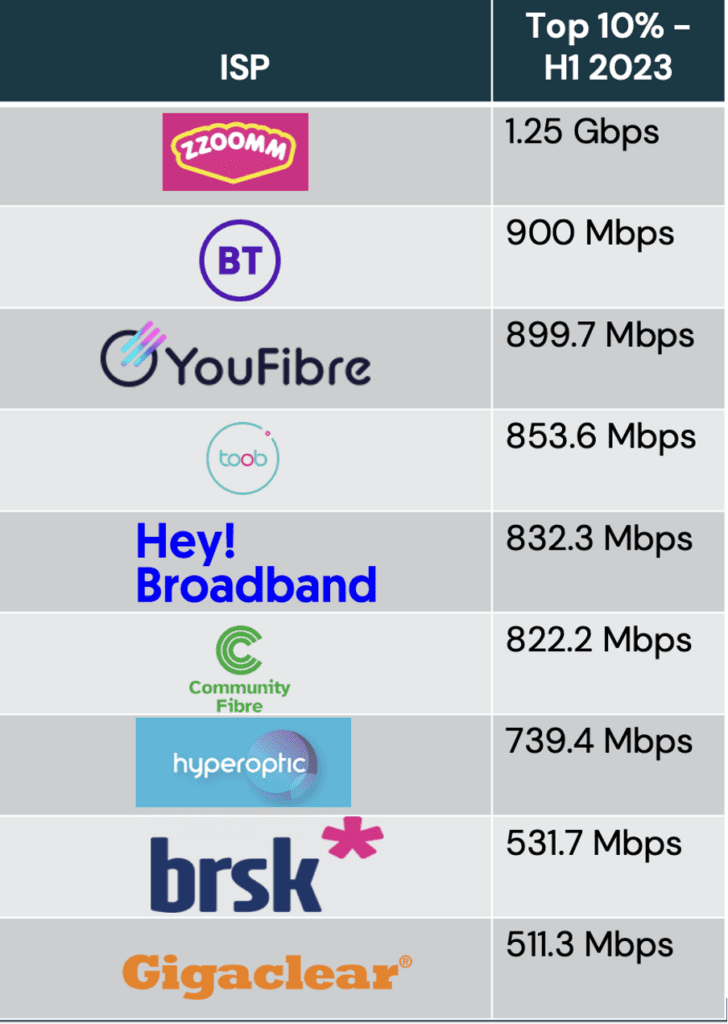

In terms of speed of network, though each Altnet claims to be faster than their counterparts the actual Mbps are similar across the Altnets, cannot be readily compared from marketing alone. In a useful article, Mark Johnson of ISP review explains that it’s wise not to read too much into Altnet speed fluctuations because “the faster you go, the more obvious the caveats of web-based speed testing become. In addition, some provider’s only sell a 1Gbps package (i.e. the results aren’t impacted by slower tiers) and may have fewer customers (lower confidence in the data), which means apples-to-apples comparisons remain tricky.” Moreover, when comparing these speeds to an incumbent such as BT, who claims to have a maximum speed of 900 Mbps, there are a few altnets, as shown in the table below, who seem to be matching BT in terms of speed.

.

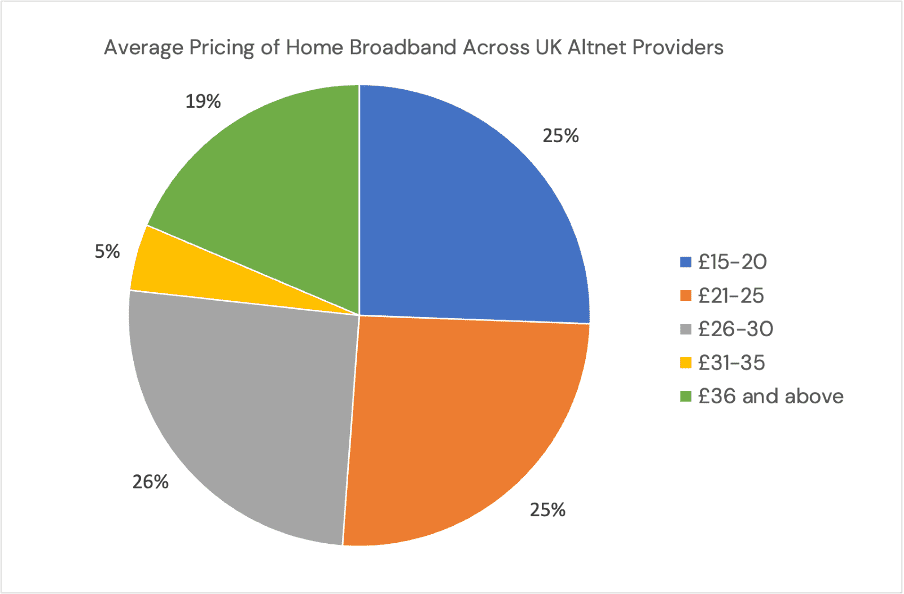

Additionally, in terms of pricing, over 75% of Altnets surveyed price their basic home broadband offering between £15 and £30, as the graph below displays.

As a note, these more expensive offerings have a higher base level speed than the cheaper offerings. For instance, Trooli, TrueSpeed, and BeFibre whose basic offering is speeds of 150 Mbps all have priced this package at £25.

Along with boasting very similar price and speed deals, nearly all of the Altnets surveyed advertised their excellent Trustpilot and customer reviews. As Cavell has highlighted again and again in its enterprise research, focus on customer experience and past customer reviews are increasingly important to telecoms buyers. In fact, for many Altnets, this customer focus seems to have a distinctly regional focus, another key feature of many of these providers. Take the Scottish Altnet BrawBand as an example. The front page of their webpage reads “Fed up of dodgy Wifi? Us too. We’re on a mission to provide Scotland with fast, reliable internet…and great pater.” This highly regionalized marketing is common across the Altnets surveyed which, again, does not meaningfully act as a key differentiator for these businesses.

While these websites paint a glowing picture of satisfied customers and rapid expansion via large building projects, public financial documentation from Companies House shows a different financial picture for most Altnets.

Financial Analysis of UK Altnet Market:

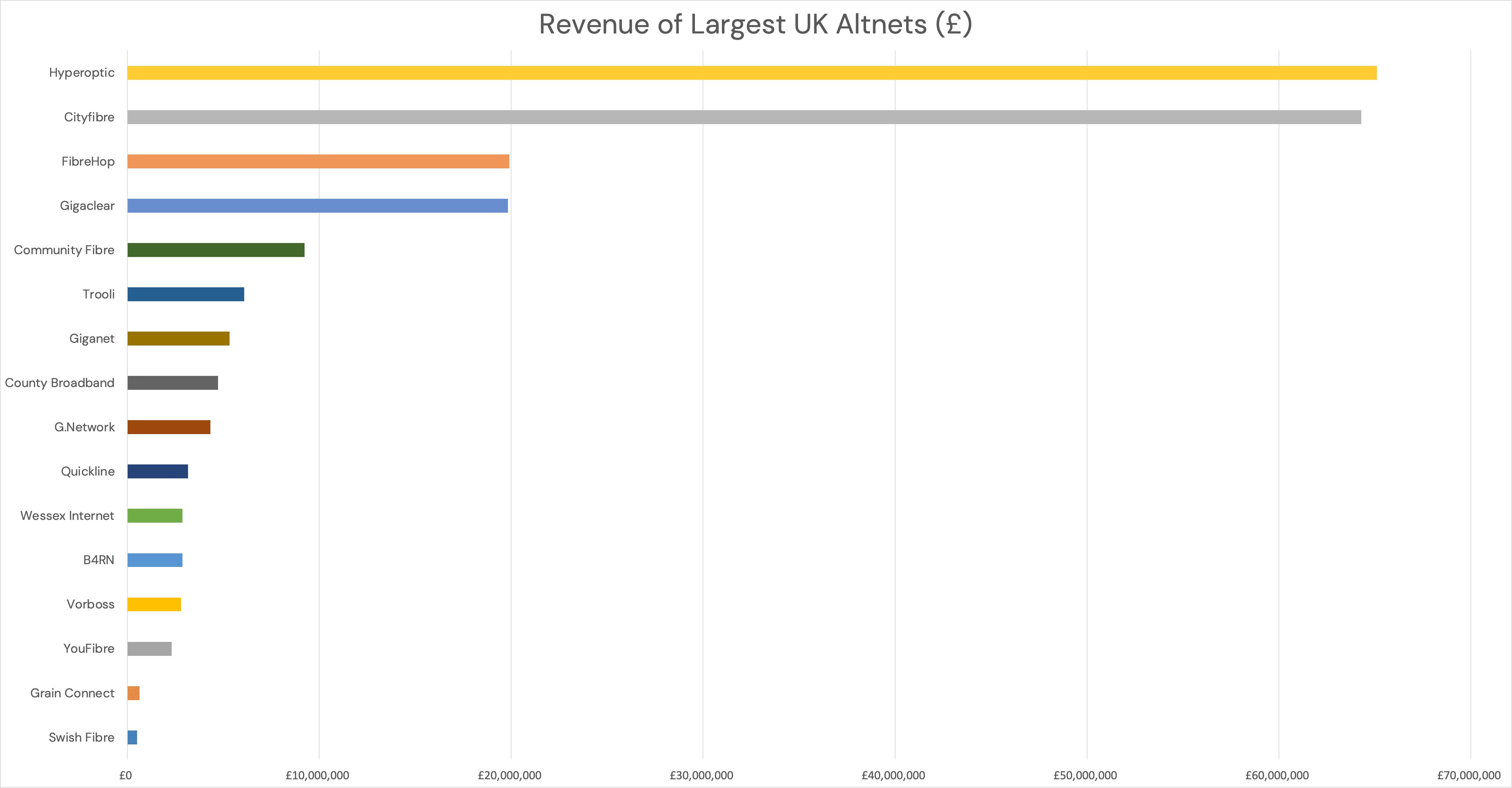

Cavell analysed publicly available financial information for the 15 largest Altnets, which have enough turnover and employees to be compelled to publish their accounts and balance sheets. Overall, Cavell’s analysis revealed a very negative financial picture. All but the four largest Altnets (Hyperoptic, CityFibre, Fibrehop and Gigaclear) have revenues less than £10 million and most have a worrying ratio between their yearly cash at bank compared to their losses.

Top 15 Altnets Cash vs Loss Assessment 2022

Overall, there is a £653 million difference between the top 15 Altnets cash at bank from this financial year and their total losses.

While Cavell understands that a large part of these financials losses are a direct results of Altnet expansion and the costs associated with it, that is physical infrastructure investment, expanding engineering and sales teams etc., there is a concern that the financial runway and investment for these providers is not long enough to keep these companies afloat and to balance of this difference, especially with debt being more expensive than when these altnets initially received their investment.

Moreover, of the top 15 Altnets analysed, only CityFibre comes out as profitable after comparing their revenues with their losses for the financial year. It is highly likely, then, that many of these Altnets, both the top 15 in terms of revenue and those much smaller, will run out of runway before they reach profitability, making further consolidation likely.

Changing Investment Landscape for the Fibre Market:

So, what does this mean for the future of the Altnet market and the investment opportunity in the space?

The Cavell team attended the Connected Britain conference in London last month and heard from a number of major players in the fibre space and what they had to say about overbuild and what the long runways to profitability may mean for the state of the market going forward.

First, it was abundantly clear that quality of investment is becoming much more important in the Altnet space. The panellists on the “changing investment landscape for the fibre market,” emphasized that as opposed to ten years ago when there was an abundance of capital, the investment community is now more focused and discerning than in the past. For instance, the investment community are looking for differentiators other than speed, and more towards companies with unique buying personas for their customers, better latency, or more competitive pricing.

Some of the criteria investors are looking for when assessing a company are having a high-quality management team coupled with a ruthless focus on the commercial viability of any new Altnet. These will be essential moving forward. And, as the panellists emphasized, a key factor in assessing this viability is predicting where there will be, or is already, overbuild in the area where the Altnet is operating. It is this overbuild that will ultimately lead to the consolidation of many of the Altnets and with it change the shape of the market for providers and investors alike.

In fact, these investors emphasized that Altnets will need to refocus their business plans to adapt to the current investment environment. A predominate aspect of this refocusing is making sure that Altnets are planning for the longer term, and building businesses cases and infrastructure that is future proof. This comes down to the interoperability and reliability of Altnet infrastructure which needs to be sustainable 10-20 years down the line.

And, with this future proofing in mind, many of the larger Altnets are already keen to pick up any distressed assets. City Fibre’s CEO stated that they are aware of the fact that they will be able to gain more users more quickly through acquisition than through continuing to build out their network, especially with labour shortages and the threat of overbuild.

Interestingly, too, there seems to be a special sort of conundrum when it comes to pinpointing what characteristics will make an Altnet flourish and what might inevitably

lead them to be the target of a roll up from the likes of Hyperoptic of CityFibre. While Altnets undoubtedly need to grow and attract customers in order to survive, the key selling point of most Altnets is owning assets and having a network that is directly tailored to the region or a community. In fact, smaller Altnets are oftentimes hyper local, with marketing and reach that positions them as the best option for a particular community. This poses problems, however, when these providers aim to go outside of their regional areas to attract new customers and grow their businesses, as what once made them unique no longer becomes a viable USP as they expand.

For this reason, the smaller regional Altnets, may be most vulnerable to failing to become profitable, especially as competition and overbuild become increasingly prominent in many regions in the UK.

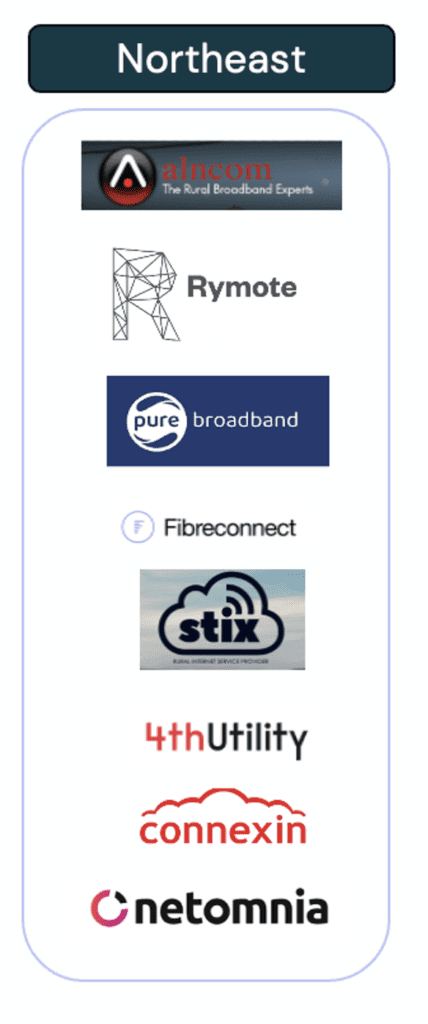

Take the northeast of England as an example. In and around Hull, there are 8 Altnet providers currently operating across this small region, making competition fierce and overbuild inevitable. Cavell predicts, then, that there might be mergers between these companies or larger players from other regions may acquire them to help gain coverage into new areas.

What is the End Game for the UK Altnet Market?

This could mean that ultimately, the nearly 100 Altnets that currently exist in the market may be whittled down to less than a dozen – with the large Altnets overtaking the highly regionalized bunch and expanding out into other areas of the UK. The panellists at Connected Britain emphasized this point with them agreeing that ultimately there will be only a few, if not one, main competitor to OpenReach, and that the highly fragmented and regionalized nature of the UK market is not something that is going to last.

Still, this vision of a UK Altnet market with just a handful of contenders is a long way off. Until then, there are a few questions that Cavell believes the investment community should be asking themselves in the short term. First, they should be paying attention to the financial information coming out at the end of FY 2023 and 2024 and asking themselves how much of a dent has an Altnet made in recruiting new customers, rolling out their services, and turning their losses into something that is closer to profit. Second, investors should be paying keen attention to the areas in the UK that currently have the most providers, and subsequently the most overbuild, as these may be the areas where there is the most potential for M&A activity. And, finally, investors should be keeping a keen eye on which Altnets are really differentiated themselves beyond the “non-USPs,” mentioned above – maybe it’s an Altnet who is creating unique buying behaviours or adding some sort of additional offering that their competitors aren’t. Cavell believes it is these players who will win out in the short term and may represent the best investment opportunity.